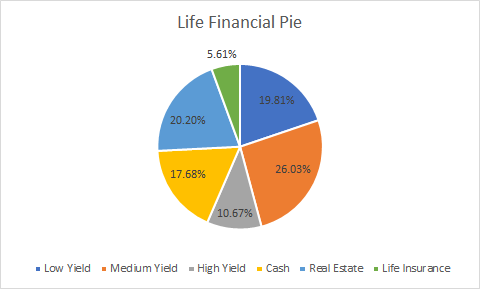

I thought it might be interesting for people to see my entire asset allocation across stock portfolios, cash, life insurance, and property. Aside from life insurance the assets at highest risk are also the smallest part of the pie. It so happens that the assets at highest risk also provide the highest income. It’s important to remember that I’m also debt free and don’t plan on taking in any new debt any time soon.

Below is my income pie. My High Yield Portfolio, while only being 10.67% of my assets supply 41% of my annual income. This is why I watch this portfolio carefully and make adjustments periodically. The Low Yield and Medium Yield Portfolios are more stable when it comes to a steady predictable income stream. The income from my Low Yield Portfolio gets reinvested to buy more shares of the companies invested.

I can’t stress enough being debt free supplies me with such piece of mind. It’s easier to adjust my monthly expenses without having to worry about making a mortgage or car payment. My core principles about debt is that personal debt is bad while business debt is good. Business debt, protected by a fictitious entity, follows the business for good or bad. It’s a layer of protection to keep your business from affecting your personal finances. If the business goes down you keep your personal assets. Personal debt is just that. You can’t escape it without personal bankruptcy.