Tag: energy

-

Boom time again for oil and gas

Thanks to a mix of events, from the Russian invasion of Ukraine to the U.S. economic recovery, fossil fuels are showing surprising resilience, despite President Biden’s push to transition to clean energy and the industry’s own history of boom-bust investing and heavy reliance on debt. U.S. production of natural gas—Chesapeake’s focus—has hit record levels. The country’s crude oil…

-

Enterprise Products Partners (EPD) Raises Distribution; 24th straight year of growth

Enterprise Products Partners L.P. (EPD) announced today that the board of directors of its general partner declared a quarterly cash distribution to be paid to Enterprise common unitholders with respect to the fourth quarter of 2022 of $0.49 per unit, or $1.96 per unit on an annualized basis. This quarterly distribution will be paid February…

-

Natural gas futures drop on warm weather forecasts

The plunge is a bad omen for drillers, whose shares were among the stock market’s few winners last year. Cheaper gas is good news for households and manufacturers whose budgets have been busted and profit margins pinched by high fuel prices. Falling natural gas prices should help to cool inflation in the months ahead. There are also…

-

Exxon & Chevron to concentrate their spending in the Americas

The two fossil-fuel giants plan to spend most of their annual budgets in the Americas this year, with Chevron saying it will pour 70% of the capital allocated for production into oil fields in the U.S., Argentina and Canada, and Exxon saying it will spend a similar portion of its budget in the Permian Basin…

-

Pembina Pipeline (PBA) announces intent to switch from monthly to quarterly dividend payouts

Some analysts say this should not affect Pembina’s dividend as it is well supported by their conservative payout ratio. It’s estimated near 60% after accounting for all capital expenditures. Subject to approval of future common share dividends by the Board of Directors, Pembina intends to move from its current practice of paying monthly dividends to…

-

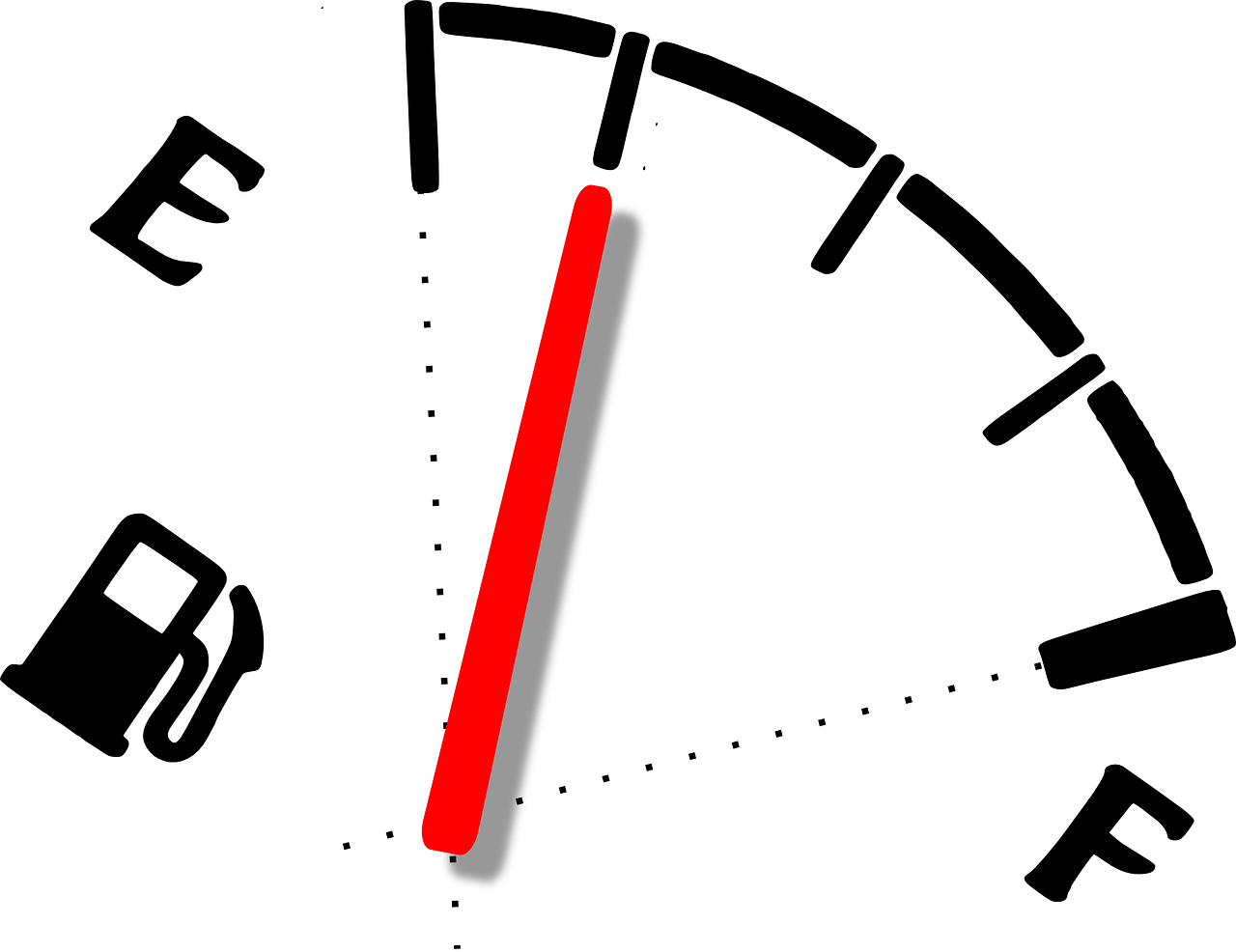

U.S. households spending almost double on gasoline versus last year

U.S. households are now spending the equivalent of $5,000 a year on gasoline, up from $2,800 a year ago, according to Yardeni Research. In March, the annual rate of gasoline spending was at $3,800, Yardeni noted. During the week of May 16, the national retail price for gasoline reached a record $4.59 per gallon, the…